Dynamic Yield Split

The core mechanism that powers Strata's risk-tranching protocol.

Overview

Strata’s Dynamic Yield Split (DYS) mechanism dynamically distributes sUSDe APY between the senior and junior tranches based on sUSDe APY, benchmark rate and the liquidity distribution between the two tranches. This mechanism creates a natural balance between risk and reward, ensuring efficient capital utilization while maintaining stability and optmizing risk–reward.

TVL Ratios

Where:

Total TVL=TVLsr+TVLjr

TVLsr and TVLjr represent the total USDe deposits in the senior and junior tranches, respectively.

These ratios determine the distribution of yield and risk between the two tranches. A higher senior TVL ratio indicates greater demand for safety, which increases the risk premium paid to the junior tranche.

Benchmark Rate

srUSDe offers a minimum guaranteed APY tied to the benchmark rate. The current benchmark rate is supply-weighted average of USDC and USDT lending rates on Aave v3 Core market.

Stablecoin lending rates on Aave serve as DeFi’s base reference rate, effectively representing the ecosystem’s on-chain risk-free rate. They provide a clearer measure of the true cost of on-chain capital and offer a more neutral benchmark for srUSDe.

Senior Tranche Yield

Where:

: Yield of the underlying asset (e.g., sUSDe).

Floor APYsr: Minimum guaranteed APY of the senior tranche linked to the benchmark rate.

Risk Premiumsr: Percentage of the BaseAPY paid by the senior tranche to the junior tranche for the risk coverage.

Risk Premium

Where:

x: Minimum risk premium (initially 20%).

y: Upper bound of the additional premium applied on top of x (initially 20%).

k: Exponential scaling factor controlling premium growth (initially 0.3).

As more liquidity flows into the senior tranche, the TVLratiosr increases, pushing the risk premium higher — rewarding junior depositors with higher yields for absorbing more risk.

Initial risk premium parameters are set by the core team, but over time independent professional risk managers will take over, actively modelling and monitoring underlying risks to recommend these parameters.

Junior Tranche Yield

The junior tranche receives:

The base yield from the underlying source, plus

The risk premium paid by the senior tranche, scaled by the TVL ratio between tranches.

This structure amplifies returns for the junior tranche, providing leveraged upside to the underlying yield.

Senior Coverage and Junior Overperformance

The senior tranche is protected by additional coverage from the junior tranche, and the leveraged yield for the junior tranche relative to the underlying APY is determined as follows:

To prevent a sudden loss of jrUSDe TVL and to maintain sufficient coverage for the senior tranche, the protocol enforces protective safeguards. If the senior coverage ratio falls below 106%, srUSDe minting is temporarily paused, and if it drops below 105%, jrUSDe redemptions are also paused.

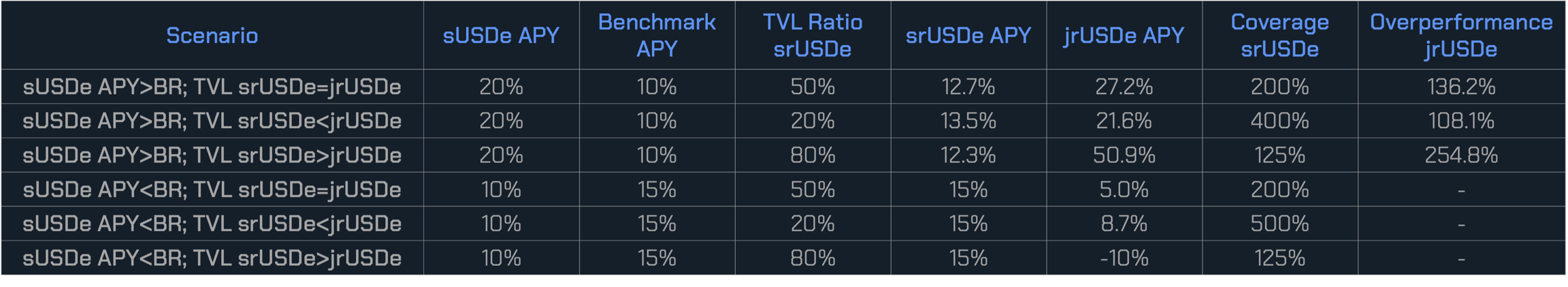

srUSDe and jrUSDe APY Simulations

The table below shows the estimated APYs of srUSDe and jrUSDe under different sUSDe APY, benchmark rate and srUSDe TVL ratio scenarios.